Apples to apples, or apples to oranges? Comparing the Inflation Reduction Act to drug-pricing programs in other countries

By Scott Shields, MBA

Introduction

In 2022, the US government passed historic legislation, the Inflation Reduction Act (IRA), that—for the first time—granted the federal government authority to negotiate drug prices based on their “value” with selected manufacturers. The IRA inched elements of the US healthcare system closer to Canada and several European countries, where drug price negotiations and assessments of value have occurred for years.

The IRA was borne out of, in part, frustration by sectors of the US Congress, and their supporters, with increasing drug prices and costs. Those itching for changes that would lower drug prices and costs referred to several reasons to remove the statutory ban on negotiating drug prices; a samplinga:

- "About one in five adults (21%) … have not filled a prescription because of the cost”

- “For nearly 20 years, the Medicare program has been at the mercy of the private sector”

- “Every person deserves access to the medications they need at a price they can afford”

This article compares the process of negotiating brand drugs by the US government with those in Canada, France, and Germany, highlighting their similarities and differences. Comparing the nascent US effort to established healthcare systems may point to how the US system may evolve.

IRA’S Price-Negotiation Details

To be eligible for negotiation, drugs must be among the top of the list of Medicare expenditures; lack any generic or biosimilar equivalents; and have already been on the market for a set number of years (9 for small molecules and 13 for biologics, though the negotiation process can start 2 years earlier).

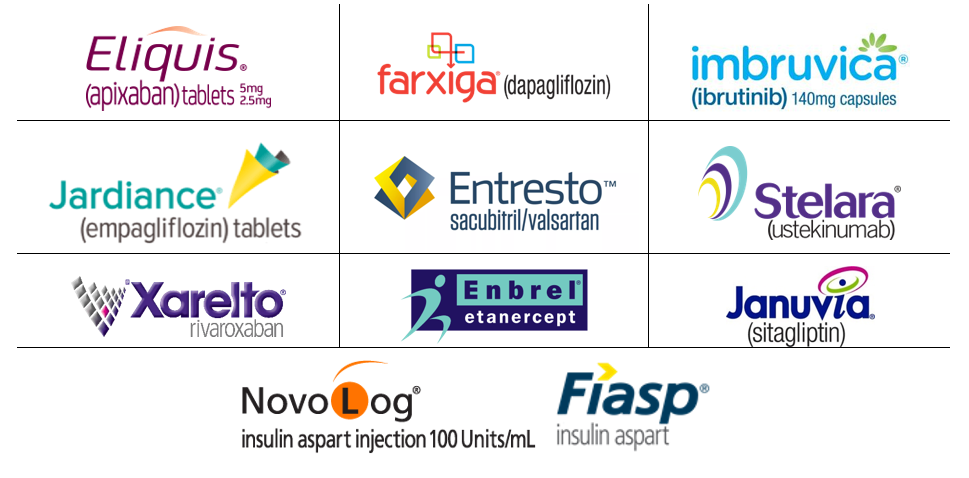

In August 2023, the US government announced the first 10 drugs to be subject to negotiation (Table 1).

Table 1. First 10 Part D drugs selected for negotiation

The new prices will go into effect in January 2026. The government will select additional drugs to be negotiated each year, with a cumulative total of 60 drugs selected for negotiation by 2030.

Drugs selected for negotiation will be subject to a maximum fair price (MFP), whereby a manufacturer must sell the drug for use by Medicare beneficiaries at no more than the MFP. When conducting the negotiation, the government is required to assess a variety of factors submitted by the manufacturer, including research and development costs, the unit cost of production, federal financial support for drug discovery, patent and revenue, and sales volume. Additionally, the government may consider whether the drug represents a therapeutic advance, the comparative effectiveness of the drug and the alternatives, and the effects of the product on specific populations (such as individuals with disabilities and whether the product addresses unmet medical needs).

The MFP only applies to the Medicare program. When selling to private insurers, for example, a manufacturer typically engages in negotiations to establish the selling price for a drug. However, many experts expect other insurers to eventually reference the MFP when negotiating prices with manufacturers.

The negotiation could reduce prices for drugs by at least 25% to 65%.

Existing Drug-Pricing Programs: Canada, France, and Germany

It is only natural that, with central governments being the primary buyers of prescription drugs, they would avail themselves of their purchasing power and seek to lower their prices. The countries we have selected employ different mechanisms to lower drug prices for their citizens.

Canada

Universal government healthcare insurance covering physician, hospital (including medicines administered there), and laboratory services exists in Canada, but medicines dispensed in the community are not included. Federal, provincial, and territorial governments have their own prescription drug plans offering varying degrees of coverage to about a quarter of the population comprising seniors, social assistance recipients, children, and some other special groups, such as cancer patients, or when costs are deemed catastrophic. A pharmaceutical manufacturer faces multiple steps to have its drug listed in government drug plans. The first step is price notification to the Patented Medicine Prices Review Board (PMPRB), a federal agency that determines the maximum price at which a drug can be sold in Canada. This price must not be “excessive.” The next step is a health technology assessment performed for all federal, provincial, and territorial drug plans (except in Quebec, which is covered by its own body, Institut national d'excellence en santé et services sociaux, or INESS) by the Canadian Agency for Drugs and Technologies in Health (CADTH), which assesses clinical, pharmacoeconomic, and ethics considerations as well as input from clinicians and patient groups. CADTH recommendations are commonly qualified with clinical criteria and/or a need for a price reduction. Following a positive recommendation, pharmaceutical manufacturers expect to be invited into the federal, provincial (including Quebec), and territorial governments’ collective price-negotiating process, known as the pan-Canadian Pharmaceutical Alliance (pCPA). If the manufacturer and pCPA reach a price agreement, a letter of intent signifies the drug will be listed in any subsequent agreement with drug plans with an established price and listing criteria. The negotiation process and agreement terms are not publicly available.France

To determine national insurance coverage for drugs, France’s Transparency Committee rates them according to their demonstrated medical benefit (“service médical rendu” [SMR]). The SMR synthesizes the benefit/risk ratio of each drug, organizing the evidence that supports coverage as “important,” “moderate,” “mild,” or “insufficient to support coverage”; the classification determines the share of the drug’s cost that national insurance will cover (between 0% and 100%). The patient bears responsibility for the remaining amount.

The prices of reimbursed drugs are regulated in France through conventions negotiated between the manufacturer and the Economic Committee for Health Products (“Comité économique des produits de santé” [CEPS]), which includes representatives from the health and economic ministries, the national health insurer, and private complementary insurers. The negotiation is framed by a national agreement, and the price of a specific drug incorporates the product’s added medical benefit (“amélioration du service médical rendu” [ASMR]), which synthesizes the benefit of the drug, in comparison with available alternatives.

The ASMR is determined by the Transparency Committee and classified as major (ASMR I), important (II), moderate (III), mild (IV), or absent (V). Drugs with an ASMR I, II, or III classification are entitled to a European price guarantee (which ensures list prices at a level similar to those in the United Kingdom, Germany, Spain, and Italy). Since 2013, the prices of ASMR I, II, and III drugs have also depended on a cost‐effectiveness evaluation conducted by the Economic and Public Health Committee. Price negotiations may further account for factors such as the price of comparators (other drugs used to treat the same or similar conditions) and the size of the population eligible for the drug (with drugs for larger populations tending to receive lower prices). The price and coverage decisions, including the ASMR and cost‐effectiveness evaluations, are reviewed at least every 5 years.

Germany

Prices for new drugs are established in Germany through collective negotiations between a single buyer (the National Association of Statutory Health Insurance Funds, the umbrella organization representing the insurers) and a single seller, the manufacturer.

Early benefit assessments of drugs begin when a manufacturer places a newly authorized pharmaceutical on the market. Pharmaceutical manufacturers have to submit a benefit dossier to the Federal Joint Committee (FJC), the key legal institution within the German healthcare system, before the medicine is made commercially available. Within 3 months of the submission, the dossier is evaluated in most cases by the Institute for Quality and Efficiency in Health Care (IQWiG). The IQWiG evaluation results in a recommendation regarding the added patient-relevant benefit of the investigated drug (assessment). Three months after IQWiG’s recommendation, the FJC concludes the benefit assessment by making a final decision regarding the added benefit (appraisal). In the case of an acknowledged added benefit, this benefit can vary to different extents (major, considerable, and minor; or not quantifiable in the case of a not determinable added benefit). Furthermore, the benefit can be classified as not available or less in comparison with a comparative therapy. In addition to that, the evidence base of the (added) benefit is differentiated between a hint, an indication, and a proof.

After the FJC decision, price negotiations between the National Association of Statutory Health Insurance (SHI) Funds and the manufacturer on the reimbursement amount begin, which is valid for SHI and private insurers. Price negotiations must be finalized within 6 months; if no agreement is reached by that time, an arbitration board is called. The arbitration board is obligated to develop a final pricing decision within 3 months, although agreements between the negotiation parties are also possible at this stage.

A manufacturer can withdraw its product from the German market if it determines the final price is low enough that it will undermine prices charged elsewhere.

Considerations

The US drug price-negotiation system has major differences from the countries we profiled. The differences have multiple causes, including political structures, belief about the role of government in citizens’ lives, and the origination of the healthcare system. Below, we discuss where the programs diverge.

Population affected

The price-negotiation system in the US affects a defined population (generally, those over 65 years of age), while the systems in most other countries include essentially the entire population. While some elected officials in the US have tried to expand the negotiated prices to other populations (e.g. those covered by private insurance), they have not yet garnered sufficient support to do so. Nevertheless, as mentioned above, stakeholders should not be surprised if payers for commercial insurance attempt to involve the Medicare MFP in price negotiations.Number of affected drugs

The US federal government will negotiate a comparatively small number of drugs compared to the countries studied. In fact, by 2030, the US government will have only negotiated prices for 60 total drugs. By comparison, the other markets studied have their governments negotiating prices with almost all branded drugs.Timing of negotiations

The IRA targets older drugs; products cannot have their prices negotiated until they have had at least 9 years (for small molecules) or 13 years (for biologics) of monopoly pricing. The other countries we studied, by contrast, start negotiating the prices of drugs around the time of regulatory approval. This means drugs in the US typically have far higher initial prices than drugs in other markets.Types of negotiated drugs

The IRA excludes a number of categories from negotiation that will likely influence research and development decisions by manufacturers as they consider which compounds to try to commercialize. The IRA specifically excludes from pricing negotiations:

- Single-source brand name drugs or biologics without approved generics or biosimilars

- Small-molecule drugs approved for less than 9 years

- Biologics approved for less than 13 years

- Drugs that have received an orphan drug designation from the Food and Drug Administration for only 1 rare disease or condition and the only approved indication is for such disease or condition

- Low-spend Medicare drugs for which total spending under Medicare Parts B and D is less than $200 million in 2026 (increased by inflation in subsequent years)

- Biological products derived from human whole blood or plasma

- Small biotech drugs for which spending falls under a certain Medicare threshold and over a certain threshold of the manufacturers’ total Medicare sales

Compared to these many exclusions, other countries we studied negotiate the prices for nearly every new brand drug or indication.

Conclusion

While the negotiation process in the US is far more modest than in other countries with established programs, it still represents a quantum leap in government authority. It will be far easier to incrementally expand the reach of the IRA’s program (e.g. increasing the number of affected drugs, increasing the affected population) than it will be to end the program. Therefore, the US system is far more likely to resemble Europe and Canada in the future than in its pre-IRA days.

All manufacturers—not just those whose products are likely to be selected for negotiation—should be aware of the IRA’s provisions and process. The MFP-setting negotiations may expand to other drugs than those enumerated in the IRA, as Congress is likely to use the IRA as a jumping-off point for expanding the pool of eligible drugs. Knowing the negotiation process and its exclusions can help manufacturers ensure their products perform as well as possible in the market.

aThe ongoing debate over drug prices and costs is a fierce one in the US, with both sides bringing quantitative and qualitative arguments to support their stances. The purpose of this article is not to evaluate the respective arguments, but to highlight the IRA’s price-negotiation provisions and how they compare to selected countries with established drug-pricing programs.

Keep up on key global health technology assessment news

HTA Quarterly

Each edition of HTA Quarterly provides insights and analysis from global experts with local market expertise on key priorities and perspectives affecting HTA.

From therapeutic area spotlights to geographic reviews to critical industry topics, keep current on HTA activity around the globe with HTA Quarterly.

Health Policy Weekly

Developed by a multi-disciplinary editorial board that includes health policy and reimbursement strategy experts, Health Policy Weekly delivers key insights to your inbox every week.

Sources

- http://www.iqwig.de/download/IQWiG_General_Methods_Version_%204-1.pdf

- https://crsreports.congress.gov/product/pdf/R/R47872

- https://gnius.esante.gouv.fr/en/players/player-profiles/economic-committee-health-products-ceps

- https://industryinitiatives.blueshieldca.com/blog/wonks-corner-how-congress-is-reining-in-outrageous-drug-prices

- https://ojrd.biomedcentral.com/articles/10.1186/s13023-022-02390-x

- https://publichealth.jhu.edu/2022/medicare-and-drug-pricing

- https://pubmed.ncbi.nlm.nih.gov/19034813/

- https://sante.gouv.fr/IMG/pdf/accord_cadre_version_definitive_20151231-2.pdf

- https://www.cadth.ca/reimbursement-review-reports

- https://www.commonwealthfund.org/international-health-policy-center/countries/germany

- https://www.congress.gov/bill/117th-congress/house-bill/5376/text

- https://www.g-ba.de/english/

- https://www.gkv-spitzenverband.de/english/about_us/about_us.jsp

- https://www.has-sante.fr/jcms/c_1729421/en/transparency-committee

- https://www.has-sante.fr/upload/docs/application/pdf/2014-03/pricing_reimbursement_of_drugs_and_hta_policies_in_france.pdf

- https://www.hhs.gov/about/news/2023/08/29/hhs-selects-the-first-drugs-for-medicare-drug-price-negotiation.html

- https://www.iqwig.de/en/

- https://www.ispor.org/docs/default-source/presentations/447.pdf

- https://www.kff.org/health-costs/issue-brief/americans-challenges-with-health-care-costs/

- https://www.kff.org/medicare/issue-brief/explaining-the-prescription-drug-provisions-in-the-inflation-reduction-act

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7984670

- https://www.pcpacanada.ca/

- https://www.canadaspremiers.ca/wp-content/uploads/2018/11/pCPA_Brand_Process_Guidelines.pdf