I-R-A or Eye-Ra - however you frame it, the new US drug pricing law is sure to have a significant impact on the global pharmaceutical market

By AmerisourceBergen

By: Daniel Fellenbaum, JD

Updated: October 21, 2022

Major reforms to the drug pricing system in the United States (US)

Overview of the IRA

This past summer, with seemingly no momentum on their side, Democrats in the US Congress passed the IRA, on a party-line vote. The comprehensive legislation covers energy and environment policy, taxes, and healthcare costs.

The drug-pricing provisions in the IRA have been debated for several years. While the policy ideas are not new, the political landscape and timing was ripe for passage of the IRA. The IRA is organized around 3 main drug-pricing provisions:

- Allowing Medicare to negotiate the price of certain high-priced drugs

- Capping drug-price increases in Medicare at the rate of inflation

- Redesigning the Medicare Part D benefit, including a $2,000 out-of-pocket (OOP) cap

Let’s dig in.

The Medicare Negotiation Program

First, and to many most notably, the IRA establishes a program to allow the federal government to negotiate the price of certain drugs that are very costly to the Medicare program. The IRA directs the US Secretary of Health and Human Services (HHS) to negotiate a “maximum fair price” for a select number of Medicare drugs each year. This is a major shift in policy, and one that will bring much uncertainty to the market.

Medicare negotiation will be here sooner than many realize, as the program is set to kick off September 2023 with publication of the first 10 Medicare Part D drugs subject to negotiation.

So, how do we know which drugs will be subject to negotiation? Drugs subject to negotiation must meet the following criteria:

1. Must be a “qualifying single-source drug”

- Approved/licensed by the US Food and Drug Administration (FDA)

- No generic or biosimilar on the market (an authorized generic drug does not count)

- Drugs must be at least 7 years post approval

- Biologics must be at least 11 years post licensure

2. Drugs with the highest total expenditures across Medicare Part B (top 50) or Medicare Part D (top 50), over the previous 12 months

3. Total number of drugs subject to negotiation each year

- 2026: 10 Part D high-spend drugs

- 2027: Another 15 Part D high-spend drugs

- 2028: Another 15 Part B or Part D high-spend drugs

- 2029 and beyond: Another 20 Part B or Part D high-spend drugs each year

Note, the total is cumulative, so for each year, an additional number of drugs will be subject to negotiation, building upon the existing list.

Some drugs are excluded from the negotiation program, including:

- Certain orphan drugs

- Part B and Part D drugs with total expenditures less than $200 million, over a 12-month period, subject to an increase by the rate of inflation

- Plasma-derived products

- Certain small biotech drugs for years 2026–2028, if in 2021:

- Total Part B and Part D expenditures for the drug were less than 1% of total Part B or Part D expenditures; and

- Represent at least 80% of the small biotech manufacturers’ Part B and Part D revenue

For all drugs selected for negotiation there is a “maximum fair price” ceiling, essentially capping the negotiation amount.

To begin the negotiation process, biopharmaceutical companies who have a product on the list are required to disclose certain product data and information, which the federal government will factor into the negotiation. This includes research and development costs, revenue in the US market, any financial support from the US government for development costs, and sales volume. More details on the negotiation process are expected from the Biden Administration.

Medicare Part B and Part D Inflationary Rebates

The second major drug-pricing policy provision of the IRA requires biopharmaceutical companies to pay a rebate (fee) to the HHS Secretary if the company raises the price of a drug faster than the rate of inflation. This is the first time the US government has had a tool to limit price increases for drugs reimbursed by Medicare.

The inflationary penalty applies to eligible Medicare Part B and Part D drugs and biologics, including biosimilars. The formula for determining the penalty, while fairly complex, is based on total units dispensed during the applicable 12-month period (October–September) multiplied by the amount (if any) by which payment for the drug exceeds the inflation-adjusted payment amount. This section applies in 2023 and 2024, which is earlier than the other drug-pricing provisions. However, the HHS Secretary may delay rebate invoices owed for 2023 and 2024 to the end of 2025.

Medicare Part D Benefit Redesign

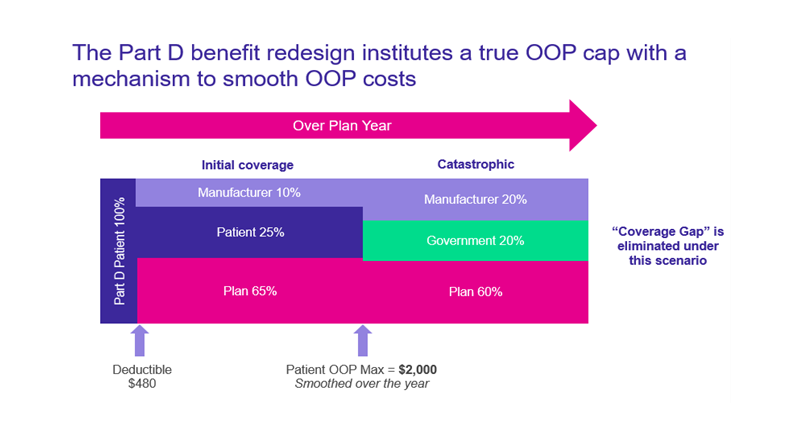

The third key drug-pricing section of the law is a redesign of the Medicare Part D benefit. The redesign makes the following changes:

- It eliminates the coverage gap, resulting in 3 phases: deductible, initial coverage, and catastrophic.

- The biopharmaceutical manufacturer will provide a 10% discount on innovator drugs in the initial coverage phase and a 20% discount in the catastrophic phase (see the new manufacturer discount program described below).

OOP - out of pocket

Patient cost-sharing protections:

- $0 cost-sharing for vaccines in Part D, starting 2023

- $0 OOP in the catastrophic phase, starting 2024

- Beneficiaries currently pay 5% in the catastrophic phase of the benefit

- Expands the Part D low-income subsidy (LIS) threshold to cover more beneficiaries under the full subsidy, starting 2024

- Caps beneficiary OOP costs at $2,000 per year, starting in 2025

- Couples the OOP cap with a “smoothing” mechanism, to allow total OOP costs to be distributed evenly throughout the plan year

- Limits annual Part D premium growth

Anything else?

- Yes, as of October 1, 2022, Part B payment for certain biosimilars is increased (for 5 years), to the average sales price (ASP) of the biosimilar plus 8% of the reference biologic’s ASP

- IRA also caps copays for insulin at $35 a month for Part D and Part B enrollees, starting 2023. This does not apply to the commercial market.

- IRA extends premium tax credits for 3 years for individuals and families buying certain health plans on the Affordable Care Act exchanges, starting January 1, 2023

- Modifies Part B payment for biosimilars that do not yet have an ASP, starting July 1, 2024

Conclusion and next steps

Biopharmaceutical companies and stakeholders who operate in the US will be impacted by these new reforms to the drug-pricing system. Understanding the full extent of the impact now is difficult, particularly the direct and indirect impact to the global pharmaceutical market.

For now, the best strategy may be to identify areas of uncertainty and prepare to influence a potential regulatory process through comments. This can be informed by modeling how the changes might affect product revenues and innovation.

There is much to be finalized over the next couple of months. The details will matter. Stay tuned.

Source:

- The Inflation Reduction Act of 2022. https://www.congress.gov/bill/117th-congress/house-bill/5376/text.