4 questions with Ben Penley

By Ben Penley

Discussing payer pre-approval information needs and how manufacturers can better meet them

What has inspired this research?

The Pre-approval Information Exchange (PIE) Act was passed in December 2022. It took much of what was specified in the Food and Drug Administration’s (FDA) Final Guidance on pre approval communications between payers and manufacturers and made it into law, creating a permanent safe harbor for manufacturers to proactively engage in PIE.

We wanted to understand, with the passage of the PIE Act, was there still a gap in the pre-approval information payers received from manufacturers versus what they needed to make formulary decisions? We also wanted to understand that if this gap existed, for which types of information was the gap most prevalent?

What are the key takeaways from your research?

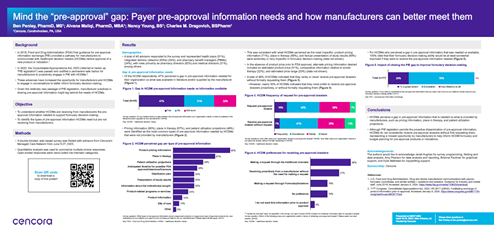

Our survey was conducted in June 2023. Of the 45 respondents, 51% represented health plans, 24% represented integrated delivery networks, and 24% represented pharmacy benefit managers. Their roles within those organizations were split between pharmacy directors (62%, and medical directors (31%, as the two leading roles. In terms of geography, there was an almost even split between national and regional plans.

Our first takeaway was that the gap still exists—about 50 percent of payers indicated that there was a gap in the pre-approval information they needed to make formulary decisions versus what was available to them, either provided by the manufacturer or publicly available.

The leading types of information for which this gap was present were product pricing information (90%), patient utilization projections (48%), and anticipated timeline for FDA approval (38%). So, understanding the cost, anticipated utilization, and when the therapy would be available were the leading types of pre-approval information payers needed but hadn’t received.

Another key finding was related to the impact of closing the gap. If payers had the pre-approval information they needed, would their decision-making be improved? In short, we found that yes, all respondents said their decision-making would be improved.

Was there anything in the research that was surprising, that you didn't expect, that you found out?

We were surprised that 50% of payers still perceived a gap, even though the PIE Act has been law for nearly 18 months. Further, only 7% of payers said they frequently received pre approval dossiers proactively. We think that manufacturers should feel empowered to share information proactively with payers so that they can make more informed decisions.

What are the next steps from this research?

Our next survey related to this topic is going to look more at outcomes of PIE. We know that payers want this information—we know payers need this information. We want to look now at what those outcomes are for manufacturers who successfully engage in PIE.

We found that all payers thought closing the PIE gap would improve their formulary decision-making. But we want to understand how exactly it would be improved. Would it just make payers more informed? Would payers be able to make decisions quicker? What impact would it have on how a product is reviewed? That's something we plan to look into in future research.

Citations relevant to the content described herein are provided in the article linked here. Readers should review all available information related to the topics mentioned herein and rely on their own experience and expertise in making decisions related thereto.